Keywords: Economic Stimulus

-

AUSTRALIA

What is often not expected or well understood is the effect of ‘lag time’ aftershocks in our regions following economic crisis. Lag time is an attribute of some rural, regional and remote communities and is most often seen in economically path dependent and single industry communities, many of which of course, comprise RRR Australia.

READ MORE

-

ECONOMICS

To date, most of the Morrison government’s economic packages could best be described as ‘economic welfare’. They are measures designed to limit the impact on the economy of the COVID-19 pandemic. The recovery phase will very much need to be about stimulating the Australian economy.

READ MORE

-

ENVIRONMENT

- Cristy Clark

- 09 April 2020

9 Comments

Even during this period of disruption (and, indeed, even because of it) it is so important that we pay attention to the bigger picture. So much of what we do now will lay the groundwork for the kind of future that we are able to build at end of this crisis.

READ MORE

-

ECONOMICS

- David James

- 01 April 2020

4 Comments

The world-wide chaos caused by the outbreak of the coronavirus has underlined a lesson that was only partly learned in the Global Financial Crisis of 2008. In a more interconnected world the understanding of system-wide risk needs to be much better than it is.

READ MORE

-

AUSTRALIA

- John Warhurst

- 23 March 2020

20 Comments

COVID-19 brings many tests. Amid the health, economic and financial crises brought about by the pandemic, our greatest test is to conduct ourselves as a robust democracy and to demonstrate that we are a fair society. Neither test will be easy to pass, but we must aim to emerge at the other end as a better society.

READ MORE

-

ARTS AND CULTURE

- Deborah Singerman

- 15 March 2020

2 Comments

I still mainly look back. The bushfire legacy lives on. It acts as a benchmark for assessing tragedy and hope. I cannot get the searing images out of my head of red, angry skies, of flames raging frighteningly, embers flying, and firefighters miraculously persevering against the odds.

READ MORE

-

ECONOMICS

- Bree Alexander

- 25 February 2020

2 Comments

After taking account of housing costs, it is estimated that 3.24 million people, equating to more than one in eight people, are estimated to be living below the poverty line in Australia. For children, it is estimated to be one in six.

READ MORE

-

AUSTRALIA

- Joe Zabar

- 18 October 2019

3 Comments

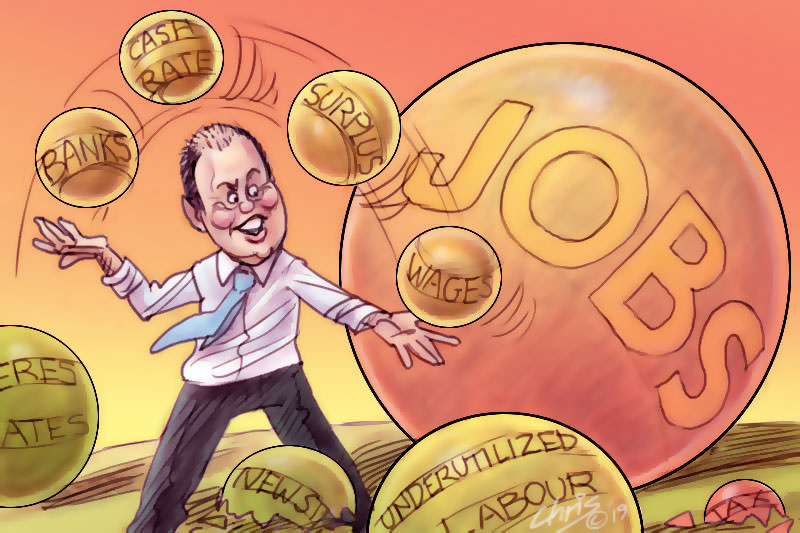

Treasurer Josh Frydenberg's attack on banks for failing to pass on the full rate cut to consumers is a political distraction. There are two clear signals coming out of the latest cut. First, monetary policy is not enough to spark a revival of the economy. Second, it's now all about jobs. Frydenberg and his officials would be wise to heed these signals.

READ MORE

-

AUSTRALIA

While the current economic climate is cause for concern, it is not the time to panic. A more sensible alternative to austerity is for governments, business, unions and charities to look for ways we can together soften the impact of any global downturn. This will require bipartisan agreement to sacrifice some or all of the budget surplus.

READ MORE

-

ENVIRONMENT

- Cristy Clark

- 04 July 2019

5 Comments

A Green New Deal in Australia would mean a stronger commitment to a government-led rapid transition to renewable energy and cleaner transport, with clear programs to support transition to well-paid green jobs in places that previously relied on resource extractive industries. This isn't necessarily as expensive as it sounds.

READ MORE

-

ENVIRONMENT

- Greg Foyster

- 19 June 2019

8 Comments

People are lacking inspiration and courage. So right now, what we need is a solution as big as the problem we're trying to solve, and the best idea on the table is a 'Green New Deal' that combines action on climate change with tackling inequality.

READ MORE

-

ECONOMICS

- Binoy Kampmark

- 13 September 2018

2 Comments

It has been a decade since the banking aristocracy Lehman Brothers filed for bankruptcy in what would be the chant of doom that became the Global Financial Crisis. Today, the legacy of Lehman Brothers and the crisis it helped precipitate supply warnings of the next shock.

READ MORE